On this page we inform you about news at ACER REMIT, explain the most important terms and answer questions about the ACER REMIT Reporting Directive.

25.09.2025 – New ACER REMIT Fees from 2026

New REMIT Fees (from 2025)

On 8 September 2025, the European Commission adopted Decision (EU) 2025/1771, which introduces a new fee framework for ACER’s REMIT-related tasks.

1. Structure

RRMs (Registered Reporting Mechanisms) pay annually:

-

Flat registration fee: EUR 15,000

-

Transaction records fee component: based on data volumes and clusters (see below)

-

Risk position reporting fee: EUR 250 per report

-

IIPs (Inside Information Platforms): fixed annual fee of EUR 15,000

2. Fees for transaction records (per data cluster)

a) Market participants on organised markets:

-

1–100 records → EUR 250

-

101–1,000 → EUR 500

-

1,001–10,000 → EUR 1,000

-

10,001–100,000 → EUR 2,000

-

100,001–1m → EUR 4,000

-

1m–10m → EUR 8,000

-

10m–100m → EUR 16,000

-

100m–1bn → EUR 32,000

-

1–2bn → EUR 64,000

-

2bn → EUR 96,000

b) Market participants outside organised markets:

-

1–10 records → EUR 250

-

11–100 → EUR 500

-

101–1,000 → EUR 1,000

-

1,001–10,000 → EUR 2,000

-

10,001–100,000 → EUR 4,000

-

100,001–1m → EUR 8,000

-

1m–10m → EUR 16,000

-

10m → EUR 32,000

3. Transitional provisions

-

2025: one-off surcharge of EUR 7.6 million, allocated to RRMs according to the number of market participants (EUR 467.17 per MP).

-

2026: additional possible surcharge up to EUR 23.5 million, allocated according to data clusters.

25.09.2025 – ACER adopted new REMIT fees for 2025

On 8 September 2025, the European Commission adopted Decision (EU) 2025/1771, which repeals the previous Decision (EU) 2020/2152 and establishes a new fee scheme to finance the activities of ACER under the REMIT Regulation (EU) No 1227/2011.

Background

ACER is responsible for monitoring Europe’s energy and trading markets. Due to new obligations – such as reporting on electricity, gas and hydrogen storage, capacity mechanisms, balancing services and high-frequency trading – ACER faces higher operating costs, which are now shared across market participants.

Fee Structure

The financing is collected via Registered Reporting Mechanisms (RRMs):

-

The total fee for 2025 amounts to EUR 7.6 million.

-

This amount is distributed proportionally among all RRMs, based on the number of market participants (MPs) for whom transaction records were submitted between 1 January and 30 June 2025.

-

The rate per market participant is EUR 467.17.

-

ACER has provided RRMs with detailed lists of included MPs to enable verification of the calculation.

Objective

-

Increase transparency and ensure fair cost allocation.

-

Guarantee sustainable funding of REMIT-related activities, reducing reliance on the EU budget.

15.09.2025 – Key changes from the draft of the new REMIT 2 Implementing Regulation

New Reporting Obligations

- Exposure Reporting (Art. 6)

- Quarterly reporting of:

- Trading positions in electricity & gas

- Forecasted generation

- Forecasted sales to end customers

- Reporting horizon: 24 months into the future.

- Threshold: market participants with < 600 GWh/year (separately for electricity and gas) are exempt.

- Start: Q1 2027 (first reports due by end of April 2027).

- Quarterly reporting of:

- Hydrogen Reporting

- From 1 July 2028 annual reporting of supply, transport and storage transactions.

- Simplified datasets (few fields).

- Exemptions: small producers (≤ 50 MW), local networks, end consumers < 600 GWh/year.

- Balancing Transactions

- New mandatory requirement, to be reported monthly and in aggregated form.

- Reason: more complete market monitoring.

- Gas Storage

- Introduction of “periodic reporting” for contracts ≥ 12 months (monthly reporting).

- Electricity storage

- To be treated as electricity supply, no separate category.

Deadlines and Reporting Intervals

- OTC Contracts

- Deadline shortened from 1 month → 10 working days after contract conclusion.

- Trades on OMPs

- Deadline extended from D+1 → D+2 (relief due to higher liquidity & IT workload).

- LNG Data

- Must be reported “as close as possible to real time”.

Simplifications & Relief

- New category “periodic reporting” → less frequent reporting (e.g. gas storage, hydrogen, balancing).

- Ad hoc reporting expanded

- Upstream pipelines, gas storage <12 months, redispatching contracts, voice-broker orders.

- Large consumer contracts (≥ 600 GWh):

- OTC reporting moved from continuous → semi-annual.

New Data Fields / Clarifications

- LNG-specific fields (e.g. vessel, terminal, price formulas).

- Algorithm ID for algo-trading.

- Identification for Direct Electronic Access (DEA).

- Additional fields for PPAs (e.g. asset type, contract mechanism).

- New Table 5 for trade-matching systems (SIDC etc.).

Inside Information & Reporting Channels

- Inside information only via IIPs (Inside Information Platforms).

- Transaction, exposure and fundamental data exclusively via RRMs.

- ACER may in future request original contracts (not only reported data).

Fundamental Data Reporting

- TSOs must additionally report imbalance settlement data monthly.

- LNG system operators: reporting now aggregated (due to virtual tank systems), no longer obliged to report planned/unplanned outages (already covered via inside information).

Legal Clarifications

- Definitions updated (e.g. “Organised Marketplace” removed, as already regulated in REMIT 2024).

- Responsibilities along the reporting chain clarified (Participant → OMP → RRM/IIP → ACER).

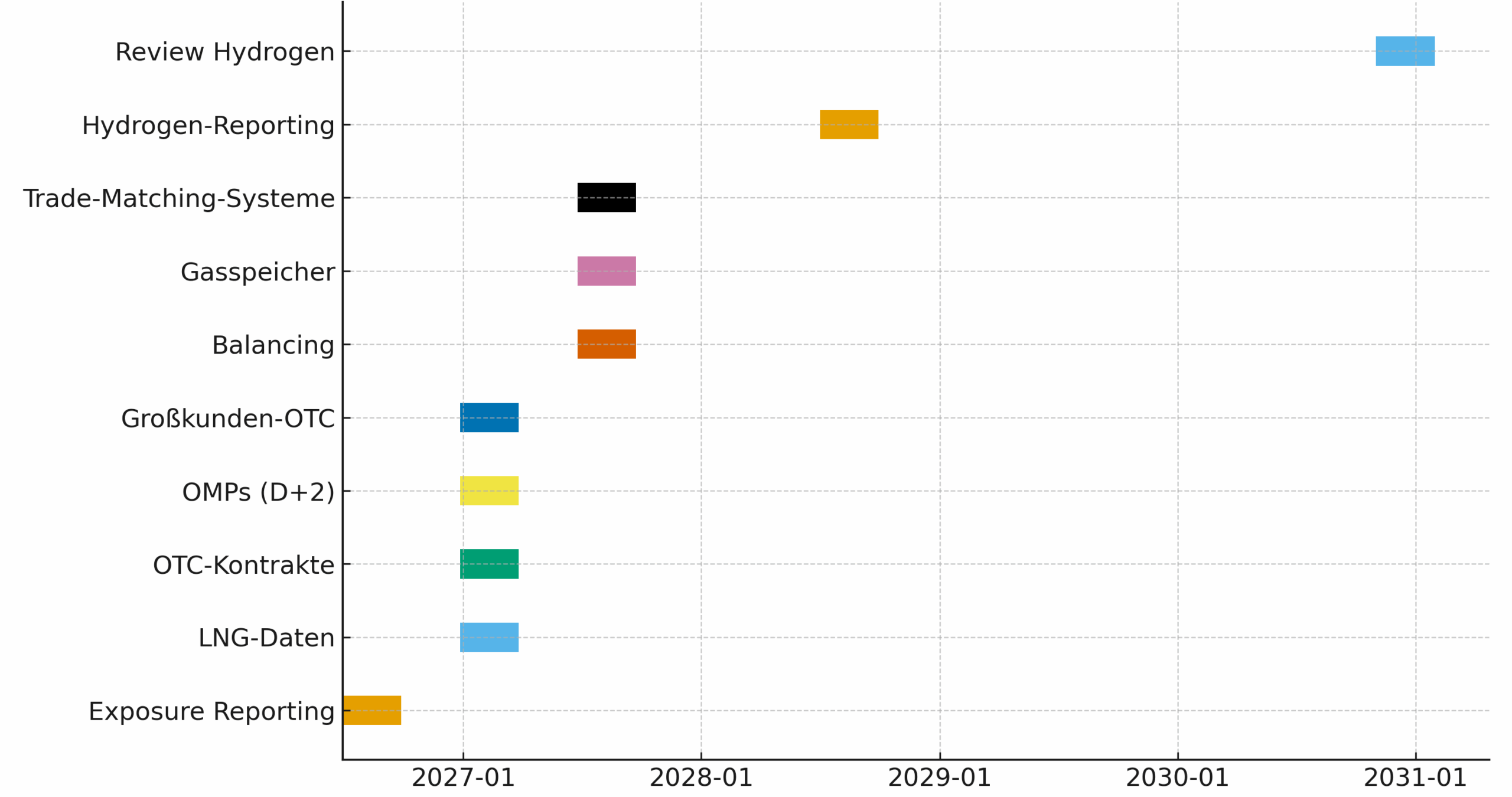

Key Dates & Transitional Periods

- 12-month transitional period: old Annex & Art. 3 from 1348/2014 apply in parallel after entry into force.

- Staggered deadlines (Art. 17):

- 6 months after entry into force: Exposure Reporting (Art. 6).

- 12 months after entry into force: LNG data (Art. 7(2)), OTC reporting (10 working days).

- 12 months after entry into force: Continuous Reporting (Art. 3), Large consumer OTC (Art. 4(2)).

- 18 months after entry into force: Balancing, Gas storage, Redispatching, Trade-matching systems (Art. 4(3)–(7), Art. 9, Art. 11(4)).

- 1 July 2028: Hydrogen Reporting (Art. 4(8)).

- 1 November 2030: ACER review → assessment whether hydrogen reporting rules need to be adapted.

Further information: Wholesale energy markets – data reporting rules (revision)

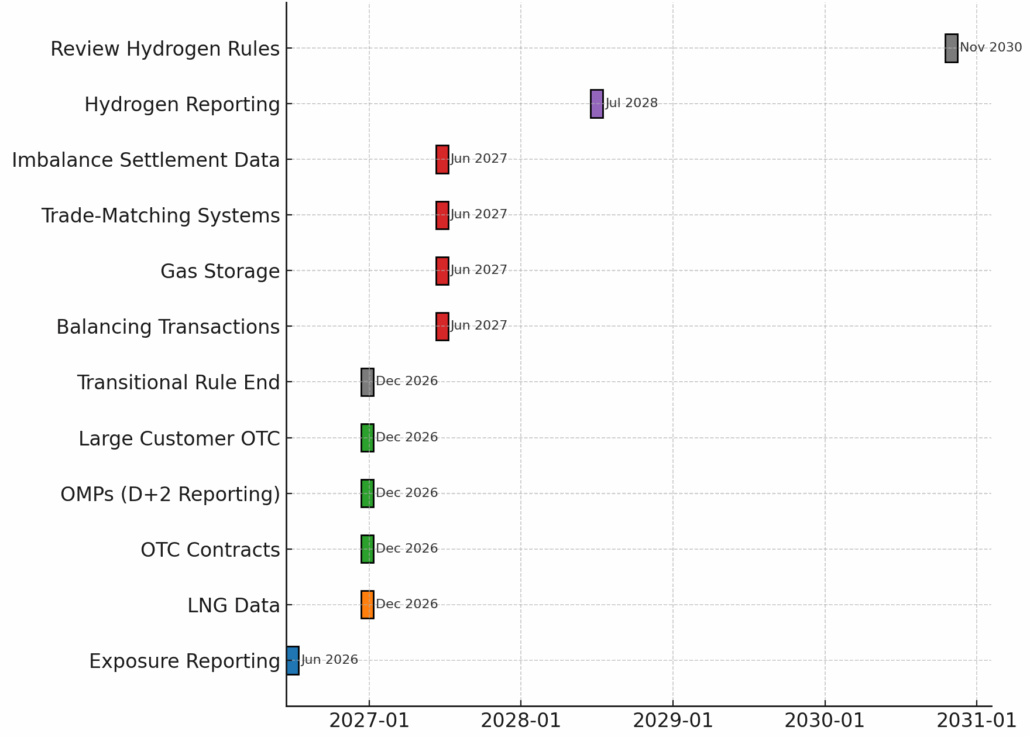

16.09.2025 – Deadlines REMIT 2 Implementation Regulation – Draft

| Topic | Affected Parties | Content | Deadline / Start |

| Exposure Reporting | All market participants >=600 GWh/year | Quarterly reporting of trading positions; forecasted generation & consumption (24 months ahead) | 6 months after entry into force (first reporting: Q1 2027) |

| LNG Data | All LNG market participants | Reporting as close to real time as possible (new LNG data fields in Table 1) | 12 months after entry into force |

| OTC Contracts | All market participants | Reporting of OTC transactions within 10 working days (instead of 1 month) | 12 months after entry into force |

| OMPs (organised marketplaces) | OMPs | Reporting of trades D+2 (instead of D+1) | 12 months after entry into force |

| Large Customer OTC (>=600 GWh) | Market participants with OTC deliveries to large consumers | From continuous reporting → semi-annual reporting (periodic reporting) | 12 months after entry into force |

| Transitional Rule | All | Old Annex & Art. 3 of 1348/2014 remain valid | 12 months after entry into force |

| Balancing Transactions | All market participants | Monthly reporting (aggregated) of balancing services | 18 months after entry into force |

| Gas Storage | Storage operators | Monthly reporting of contracts >=12 months | 18 months after entry into force |

| Trade-Matching Systems | Operators of trade-matching systems | Direct reporting of specific data to ACER (new Table 5) | 18 months after entry into force |

| Imbalance Settlement Data | TSOs | Monthly reporting to ACER | 18 months after entry into force |

| Hydrogen Reporting | Market participants in the hydrogen market | Annual reporting (delivery; transport; storage; balancing). Simplified dataset. Exemptions for small producers (<50 MW) & consumers <600 GWh/year | 1 July 2028 |

| Review Hydrogen Rules | ACER | Review whether hydrogen reporting rules need adjustment | 01. Nov 30 |

REMIT 2 Draft – Key Deadlines

New REMIT 2 Implementing Regulation

EU Tightens Market Transparency: New REMIT Implementing Regulation Covers LNG, Hydrogen and Expands Reporting

The European Commission has unveiled a new Implementing Regulation under REMIT (Regulation on Wholesale Energy Market Integrity and Transparency), replacing the existing Implementing Regulation (EU) No 1348/2014 after a 12-month transition. The reform aims to close loopholes, simplify procedures, and extend coverage to new energy markets such as LNG and hydrogen.

More markets, more data

For the first time, liquefied natural gas (LNG) — and from 2028 also hydrogen — will fall under REMIT reporting obligations. Market participants will also have to provide exposure reports: forward-looking forecasts of generation, consumption, and hedging strategies over a 24-month horizon. ACER, the EU’s energy regulator, expects these reports to strengthen its ability to monitor for market abuse.

From real-time to periodic

The regulation now distinguishes two types of reporting:

-

Continuous (D+2): e.g. exchange-traded contracts on Organised Market Places (OMPs).

-

Periodic (semi-annual or annual): for large OTC supply contracts above 600 GWh, storage and balancing services, capacity mechanisms, and hydrogen contracts.

For OTC deals, companies will have up to 10 working days to file reports — a notable change from continuous reporting under the old regime.

Expanded data tables

The technical annexes see major expansion:

-

Table 1 (standard contracts) grows from 58 to 89 fields, including many LNG-specific entries.

-

Table 2 now captures power purchase agreements (PPAs).

-

Tables 3 and 4 (electricity and gas transportation) add fields on capacity auctions and allocation mechanisms.

-

Table 5 is entirely new, covering trade-matching systems such as the Single Day-Ahead Coupling (SIDC).

New responsibility chain

All transactional and fundamental data must be routed through Registered Reporting Mechanisms (RRMs), while inside information disclosures will pass through newly designated Inside Information Platforms (IIPs). Both RRMs and IIPs are explicitly liable for ensuring the completeness, accuracy, and timeliness of reporting.

Industry impact

-

Trading venues (OMPs): required to deliver more detailed order and matching data.

-

Storage and LNG operators: now solely responsible for reporting, ending duplicate submissions by market participants.

-

Large suppliers and consumers: benefit from reduced OTC reporting frequency but face the new burden of exposure reporting.

-

Regulators: gain access to a broader and higher-quality dataset, reducing blind spots in market surveillance.

30.05.2025 – REMIT II – What Market Participants Need to Know

The EU’s revised REMIT Regulation (EU No. 1227/2011) — commonly referred to as REMIT II — was adopted in early 2024 and introduces significant changes to strengthen transparency, market integrity, and enforcement in Europe’s wholesale energy markets.

Here’s what’s coming and how remitcloud.de helps ensure compliance.

🔍 Key Changes at a Glance

1. EU Representative Requirement for Third-Country Market Participants

Companies based outside the EU will be required to appoint an official EU representative. This representative must be registered with ACER and the competent national regulatory authority (e.g. Bundesnetzagentur in Germany) and serve as the formal point of contact for compliance and enforcement matters.

➡ Our solution: remitcloud.de offers a full EU representative service, including mandate setup, registration, address provision, and regulatory communication.

2. Expanded Reporting Obligations

REMIT II adds new categories of reportable data and strengthens existing ones, particularly regarding:

- Fundamental data (e.g. electricity, storage, LNG terminals, capacity constraints)

- Order and transaction reporting in greater detail and frequency

- Standardized formats, validation rules, and deadlines

➡ Our solution: As a certified RRM, we support the complete ACER reporting scope – TRUM, UMM, fundamental data, and more – including automated validation and integration.

3. Stronger Regulatory Powers

ACER and national regulators will be granted broader powers to investigate and enforce compliance across borders, with streamlined cooperation mechanisms.

➡ Our solution: We provide proactive alerts, audit-proof data logs, and support throughout inspections or regulatory requests.

💡 What It Means for You

Whether you’re already reporting under REMIT or preparing to enter the EU market, REMIT II brings new legal, technical, and procedural requirements. Non-compliance may result in enforcement actions, delays, or market access issues.

✅ Why Remitcloud.de?

We provide an integrated, cost-efficient REMIT compliance platform:

- ✅ Full support for ACER and ElCom reporting

- ✅ Publication of inside information via certified IIP

- ✅ EU representative service for third-country entities

- ✅ LNG and storage reporting included

- ✅ Custom integrations & flexible automation

- ✅ Significantly more affordable than many competitors

📩 Stay Ahead of REMIT II

The new regulation will impact all market participants in the EU and beyond. Now is the time to assess your readiness and secure a partner with the tools and expertise to guide you.

📧 Reach out to us for a consultation or live demo:

info@remitcloud.de | www.remitcloud.de

15.05.2025 – REMIT Reporting in Switzerland: New Obligations Coming in 2026

Switzerland will implement its own regulatory framework for energy market transparency and integrity starting in 2026, with the introduction of the new Federal Act on Supervision and Transparency in the Wholesale Energy Market – commonly referred to as Swiss REMIT. This law aligns closely with the EU’s REMIT Regulation but is tailored to the Swiss energy market.

Below is an overview of what changes are coming and how market participants – especially those based outside of Switzerland – should prepare.

What is Swiss REMIT?

Adopted in March 2025, Swiss REMIT establishes a legal framework for the monitoring of wholesale electricity and gas trading activities. The new law requires market participants to:

- Register with the Swiss regulator (ElCom)

- Report wholesale energy transactions and orders

- Publish inside information

- Comply with market abuse prohibitions (e.g. insider trading, market manipulation)

Official text:

Federal Act (Fedlex) DE, FR, IT

When does it apply?

Swiss REMIT is expected to enter into force in 2026, with a transitional phase and specific compliance deadlines.

📑 What needs to be reported?

Market participants will be required to report the following data to ElCom:

| Data Type | Electricity | Gas |

|---|---|---|

| Transactions (e.g. OTC, exchange-traded) | ✅ | ✅ |

| Orders to trade | ✅ | ✅ |

| Fundamental data (generation, storage, etc.) | ✅ | ✅ |

| Inside information (e.g. outages) | ✅ | ✅ |

This includes reporting on LNG terminals, storage capacities, and cross-border capacity bookings.

🌍 Foreign companies: Representation requirement

Non-Swiss market participants must appoint a local representative in Switzerland. This representative will act as the official contact for all regulatory communications with ElCom – similar to the new EU REMIT II requirement for non-EU entities.

⚖️ Penalties for non-compliance

Swiss REMIT introduces significant sanctions for violations, including:

- Fines of up to 15% of Swiss annual turnover

- Criminal penalties for market manipulation or deliberate insider trading

- Reputational damage and regulatory enforcement

✅ How remitcloud.de can help

At remitcloud.de, we offer complete Swiss REMIT compliance support:

- Automated reporting of transactions, fundamental data, and inside information to ElCom

- ACER-style IIP platform for public disclosure

- Swiss representative service for non-domestic market participants

- LNG, gas storage, electricity and cross-border capacity reporting

- Early compliance guidance & transition support

📣 Be proactive – prepare for 2026

Swiss REMIT introduces a new era of transparency and regulation in the Swiss energy market. Early preparation ensures seamless compliance, lower risk, and reduced operational burden.

📩 Get in touch with our team for a consultation or live demo:

✉️ info@remitcloud.de | 🌐 www.remitcloud.de

11.04.2025 – Swiss REMIT: Major Regulatory Changes Coming in 2026

In 2026, Switzerland will introduce a comprehensive legal framework for transparency and oversight in the wholesale energy market. The new Federal Act on Supervision and Transparency in the Wholesale Energy Market (known as Swiss REMIT) aligns closely with the EU’s REMIT regulation but is adapted to national conditions.

This new law establishes mandatory reporting obligations, enhanced monitoring powers for the regulator, and strict rules against market abuse. It applies to both electricity and gas trading in the wholesale market – and includes significant requirements for companies based outside Switzerland.

Below is a concise overview of the most important changes.

Swiss REMIT – Key Highlights

| Key Area | Summary |

|---|---|

| Purpose | Ensures transparency and integrity in the Swiss wholesale electricity and gas markets. |

| Reporting Obligations | Mandatory reporting of transactions, orders, fundamental data, and publication of inside information. |

| Registration Requirement | All market participants must register with ElCom; non-Swiss entities are required to appoint a Swiss legal representative. |

| Prohibitions & Sanctions | Insider trading and market manipulation are explicitly prohibited. Sanctions include financial penalties, trading bans, and imprisonment (up to 5 years). |

| Market Surveillance | ElCom is granted extended powers. Market intermediaries are obligated to report suspicious transactions. |

| Technical Requirements | Participants must submit data in standardized digital formats and implement internal controls, especially for algorithmic trading. |

| Entry into Force | The law is expected to come into force in 2026, with transitional periods for implementation. |

📘 Official source: Fedlex – Swiss REMIT Law (2025) – BATE