This website uses cookies so that we can provide you with the best user experience possible. Cookie information is stored in your browser and performs functions such as recognising you when you return to our website and helping our team to understand which sections of the website you find most interesting and useful.

On this page we explain the most important terms and questions about reporting of the Standard & Non-Standard Contract.

Definition of Standard Contract

The ACER REMIT Implementing Regulation imply that any contract admitted to trading at an organised market place is a standard contract.

Furthermore, if the same contract is traded outside the organised market place, this shall still be considered a standard contract.

When a contract for the delivery of gas or electricity at a specific delivery point or zone is not admitted to trading at an organised market place, but only bilaterally between the two parties, that contract should not be considered a standard contract

ACER Transaction Reporting User Manual (TRUM)

Version 6.0, 13.03.2024, Pages 19-20

Uncertainty about the specifications of a standard contract agreed bilaterally

The Agency understands that there might be some circumstances where market participants may not have full visibility to the specifications of the standard contracts traded on organised market places. Therefore, whenever two market participants enter into a bilateral contract agreed outside an organised market place and, despite the information provided by the public List of Standard Contracts available on the ACER website, they do not have the certainty that their contract is the same as the one traded on organised market places, it can be assumed that the bilaterally agreed contract normally entails some elements of customisation. These elements of customisation distinct the bilateral contract from contracts on wholesale energy products admitted to trading at an organised market place.

They may therefore report such a contract on a T+1 month basis and, where the contract has a defined price and quantity, with Table 1 of the Annex to the REMIT Implementing Regulation.

ACER Transaction Reporting User Manual (TRUM)

Version 5.1, 16.11.2022

Page 21

Non-Standard contracts specifying an outright volume and price reported with Table 1

Article 5(1) of the REMIT Implementing Regulation states that “details of transactions executed within the framework of non-standard contracts specifying at least an outright volume and price shall be reported using Table 1 of the Annex”.

This implies that even if the contract is considered a non-standard contract, but has an agreed price and quantity, the contract has to be reported using Table 1 of the REMIT Implementing Regulation. However, it is important to note that under the non-standard contract reporting requirements such a contract would be reportable no later than 30 days from its execution (even if reported in Table 1), and not within the time limit for standard contracts transactions for which the reporting shall take place no later than the following business day.

ACER Transaction Reporting User Manual (TRUM)

Version 5.1, 16.11.2022

TRUM Page 21

Clarification of standard vs non-standard contract

This guidance aims to clarify the Agency’s understanding of the difference between a standard

contract and a non-standard contract based on Article 2 of the REMIT Implementing Regulation :

- ‘standard contract’ means a contract concerning a wholesale energy product admitted to trading at an organised market place, irrespective of whether or not the transaction actually takes place on that organised market place;

- ‘non-standard contract’ means a contract concerning any contract on a wholesale energy product that is not a standard contract;

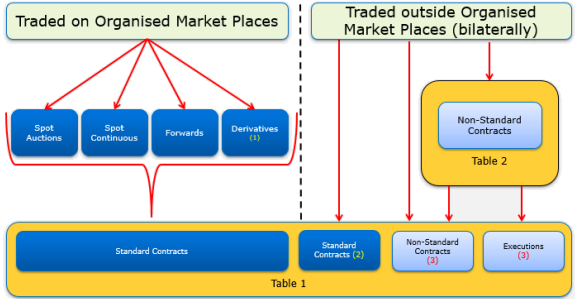

(1) Trades not reported under EU financial legislations

(2) Contracts that are admitted to trade at organised market places but traded bilaterally

(3) Non-standard contracts with defined price and quantity (indicated as ‘BILCONTRACT’ in the transaction report under Contract Name in Data Field 22) and details of transactions executed within the framework of non-standard contracts specifying at least an outright volume and price (indicated as ‘EXECUTION’ in the transaction report under Contract Name in Data Field 22)

shall be reported using Table 1 of the Annex to the REMIT Implementing Regulation.

ACER Transaction Reporting User Manual (TRUM)

Version 5.1, 16.11.2022

TRUM Page 22

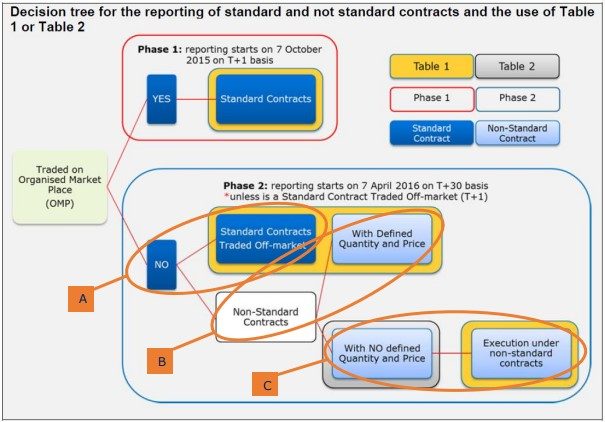

Decision tree for the reporting standard and non-standard contracts and the use of Table 1 or Table 2

The 31st edition covers the last quarter of 2022 and features:

- An assessment of the operation and transparency of different categories of organised market places and ways of trading, detailing market participants’ activity and the trends in REMIT data reporting and data collection;

- The statistics for registered reporting mechanisms’ (RRMs’) contingency reports;

- An updated overview of the sanction decisions for the year 2022, with 350 REMIT cases under review at the end of the fourth quarter; and

- A summary of the most recent updates of REMIT documents.

See: REMIT News: ACER’s latest REMIT Quarterly is out | www.acer.europa.eu

See: REMIT Reports and Recommendations | www.acer.europa.eu

- A – is for products that are concluded bilaterally but are theoretically suitable for the exchange (organised market place) (e.g. supply contract for spot quantities, forward quantity: 30 MW base with the price 25 €/MWh).

These products must be reported in the format “REMITTable1” by the following day (T+1) at the latest. - B – is for bilateral products not eligible for exchange where price and quantity are known.

These products can be reported in the “REMITTable1” format up to one month (T+30) after contract conclusion. - C – is for bilateral contracts where either price, quantity or both are unknown (e.g. full supply contract, schedules, index products).

These products can also be reported in the format “REMITTable2” up to one month (T+30) after conclusion of the contract.

If price and quantity become known after the end of the month, an “Execution” message is to be created and sent at about the same time as invoicing. The “REMITTable1” format is used for the “Execution” message.

Clarification of outright volume and price and reporting frequency

Once the volume and the price of the transaction is known to the two market participants, the transaction is complete. This can occur after the delivery of the commodity.

Details of transactions executed within the framework of non-standard contracts specifying at least an outright volume and price are available to both parties to the contract by the invoicing date at the latest.

On that basis, executions under the framework of non-standard contract are reportable no later than 30 days after the invoicing date using Table 1.

Page 26-27

How to define the timestamp of transaction in the execution message?

Transaction timestamp (field 30) in EXECUTIONS reported in Table 1 under the framework of non-standard contracts

When reporting executions using Table 1, the exact transaction timestamps reported by the involved market participants may be different. Therefore, this field should indicate the timestamp when each market participant confirms the price and the quantity for the particular contract. Since the exact and matching execution time may be not known by the market participants reporting each its own side of the trade, this field should be populated indicating the date only. As the field in the schema is a datetime one, it can be indicated the default time of 00:01:00 UTC.

Lifecycle events

The REMIT transaction reporting lifecycle events via Table 1 and Table 2 include:

a) the submission of a bilateral contract, an order or a trade for the first time will be identified as “new”;

b) the submission of the modification of details of a previously reported record due to the business event or cause will be identified as “modify”;

c) the invalidation of a previously wrongly submitted bilateral contract, an order or a trade will be

identified as “error”; and

d) the submission of the early termination of an existing bilateral contract (e.g. an early termination of a contract) or trade (e.g. cancelation of the trade due to the novation), or cancellation of an order (e.g. permanent withdrawal of an order) due to the business event will be identified as “cancel”.

TRUM, page 32