15.09.2025 – Key changes from the draft of the new REMIT 2 Implementing Regulation

New Reporting Obligations

- Exposure Reporting (Art. 6)

- Quarterly reporting of:

- Trading positions in electricity & gas

- Forecasted generation

- Forecasted sales to end customers

- Reporting horizon: 24 months into the future.

- Threshold: market participants with < 600 GWh/year (separately for electricity and gas) are exempt.

- Start: Q1 2027 (first reports due by end of April 2027).

- Quarterly reporting of:

- Hydrogen Reporting

- From 1 July 2028 annual reporting of supply, transport and storage transactions.

- Simplified datasets (few fields).

- Exemptions: small producers (≤ 50 MW), local networks, end consumers < 600 GWh/year.

- Balancing Transactions

- New mandatory requirement, to be reported monthly and in aggregated form.

- Reason: more complete market monitoring.

- Gas Storage

- Introduction of “periodic reporting” for contracts ≥ 12 months (monthly reporting).

- Electricity storage

- To be treated as electricity supply, no separate category.

Deadlines and Reporting Intervals

- OTC Contracts

- Deadline shortened from 1 month → 10 working days after contract conclusion.

- Trades on OMPs

- Deadline extended from D+1 → D+2 (relief due to higher liquidity & IT workload).

- LNG Data

- Must be reported “as close as possible to real time”.

Simplifications & Relief

- New category “periodic reporting” → less frequent reporting (e.g. gas storage, hydrogen, balancing).

- Ad hoc reporting expanded

- Upstream pipelines, gas storage <12 months, redispatching contracts, voice-broker orders.

- Large consumer contracts (≥ 600 GWh):

- OTC reporting moved from continuous → semi-annual.

New Data Fields / Clarifications

- LNG-specific fields (e.g. vessel, terminal, price formulas).

- Algorithm ID for algo-trading.

- Identification for Direct Electronic Access (DEA).

- Additional fields for PPAs (e.g. asset type, contract mechanism).

- New Table 5 for trade-matching systems (SIDC etc.).

Inside Information & Reporting Channels

- Inside information only via IIPs (Inside Information Platforms).

- Transaction, exposure and fundamental data exclusively via RRMs.

- ACER may in future request original contracts (not only reported data).

Fundamental Data Reporting

- TSOs must additionally report imbalance settlement data monthly.

- LNG system operators: reporting now aggregated (due to virtual tank systems), no longer obliged to report planned/unplanned outages (already covered via inside information).

Legal Clarifications

- Definitions updated (e.g. “Organised Marketplace” removed, as already regulated in REMIT 2024).

- Responsibilities along the reporting chain clarified (Participant → OMP → RRM/IIP → ACER).

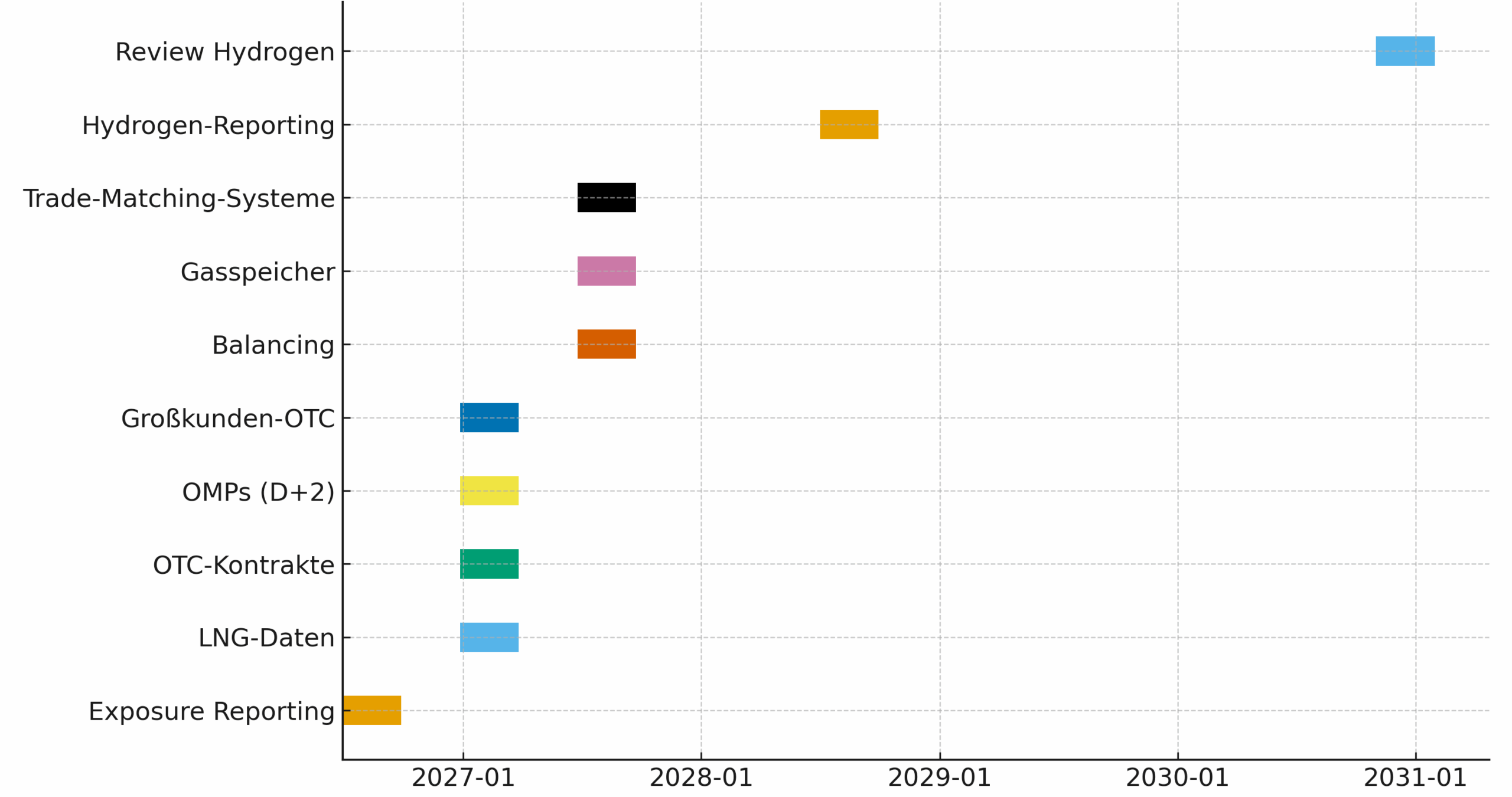

Key Dates & Transitional Periods

- 12-month transitional period: old Annex & Art. 3 from 1348/2014 apply in parallel after entry into force.

- Staggered deadlines (Art. 17):

- 6 months after entry into force: Exposure Reporting (Art. 6).

- 12 months after entry into force: LNG data (Art. 7(2)), OTC reporting (10 working days).

- 12 months after entry into force: Continuous Reporting (Art. 3), Large consumer OTC (Art. 4(2)).

- 18 months after entry into force: Balancing, Gas storage, Redispatching, Trade-matching systems (Art. 4(3)–(7), Art. 9, Art. 11(4)).

- 1 July 2028: Hydrogen Reporting (Art. 4(8)).

- 1 November 2030: ACER review → assessment whether hydrogen reporting rules need to be adapted.

Further information: Wholesale energy markets – data reporting rules (revision)